The digitized signature is one of the many tools that are part of the digital transformation that contribute to making companies more competitive. Today we tell you in what state is the process of adaptation of the insurance sector and how the digital signature can help improve the customer experience.

Technological advances have changed in a very short time the way in which clients relate to companies of any kind. They must stay current and not be left behind, as is happening with many traditional insurers. They have not been able to see what the market trends were and apply them, so other companies, especially startups born in recent years in the digital era, have subordinated them.

The latter have been able to take advantage of the latest technologies, such as blockchain or big data, and integrate them into their business model. The evolution of this type of insurance company has led to what is known as insurtech. This has been enhanced by the irruption in the labor market of the millennial generation, much closer to technological innovation, the emergence of concepts such as the Internet of Things and the appearance of new economic models such as the collaborative economy.

Currently, according to data from the Insurtech Observatory, the insurance sector is in a medium-low degree of development of digital transformation. Only 12.5% consider that the level is 4-5 out of five.

The lack of development of digital capabilities was also demonstrated through the report made by the Capgemini Research Institute with more than 360 interviews. In this research, it was concluded that only 37% of the insurers were in a position of maturity, while 56% were still in the first steps of the transformation.

Regarding the obstacles, the executives highlighted the lack of a transversal and leadership vision to carry out this much-needed process. The 74% say they do not “have a road map from the high level for the digital transformation process”. In addition, 70% of insurers declare they do not have the necessary digital capabilities and 72% lack the leadership capabilities.

Changes of digital transformation in insurance

All changes promoted by digital transformation are necessary for insurance companies to maintain their competitiveness and remain attractive to their customers, increasingly accustomed to the use of new technologies and to perform all kinds of paperwork in a digital manner (even with the Public Administration).

The digital strategic consultancy Multiplica made a report on what are the seven main drivers in the digital transformation that will make the industry completely change the way you work and interact with your customers.

Precisely, customers are one of the most important points of this period of change, as the report indicates: customer-centricity. The objective is to improve the experience of a client that has been acquiring new profiles, concerns and demands over time, which insurance companies, largely, have not been able to satisfy.

According to Global Trend Map, collected by Multiplica, 70% of insurers are not satisfied with their level of commitment to customers, and less than half (45%) consider their organization to be customer-focused.

Deloitte offers five important aspects on how customer-centricity strategy should focus: to fully understand customers and the customer journey; always put your needs first; know your opinions before offering new services or update them; transform transactional relationships into emotive ones; and modify the company mentality to focus fully on the client.

This mentality of putting the client first and their needs first can also benefit the company, as well as the obvious benefits that customer satisfaction brings. The introduction of new technologies and their integration into the organization and business culture means many advantages.

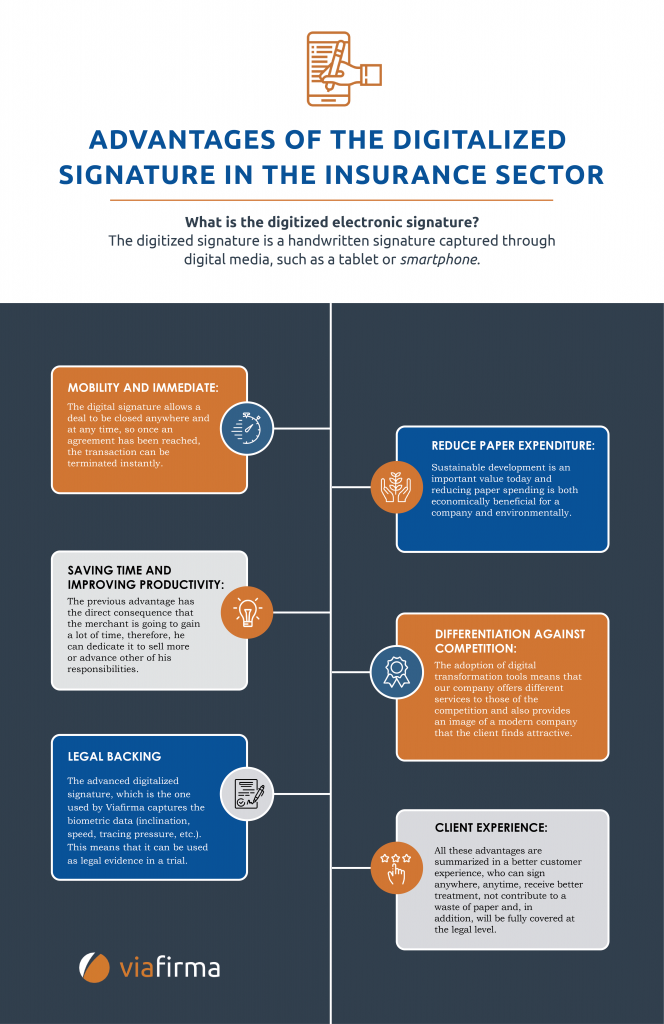

For today, we will focus on the digitized signature and which can bring both the company and the end user in the following infographic.

INFOGRAPHY: Advantages of the digitized signature in the insurance sector